Our February report covers commercial real estate trends from our MLS – arming investors, tenants & brokers with the data to make smart decisions.

Prices stayed stable month-over-month with occupancy rates climbing and more assets hitting the market.

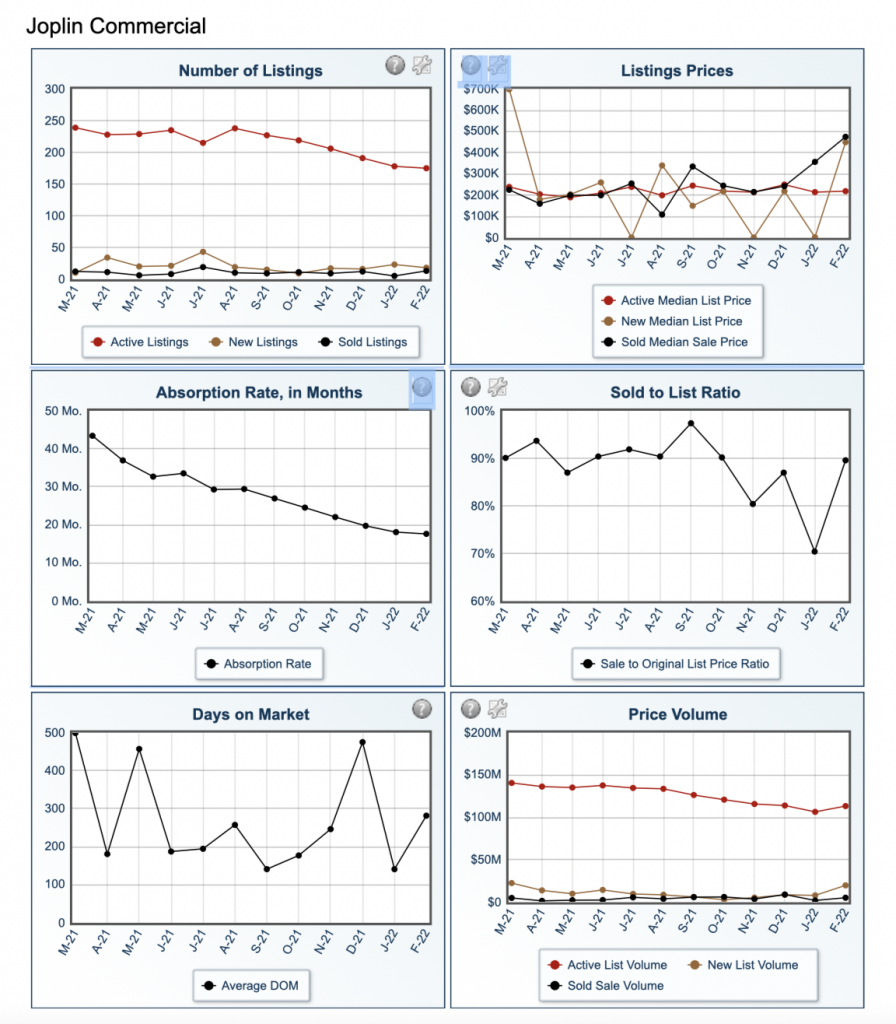

Overall, average asking prices for new assets showed little change from January. This stability is promising for the Joplin market, particularly given the global stage of newsworthy events occurring in February. In the same period, occupancy rates modestly climbed.

In February, the market saw a subtle decline in new listings for sale compared to January. This sixth consecutive month of decrease in total new listings added represents the commercial real estate climate.

Industrial and multifamily experience modest pricing growth, slowing from January surge.

Industrial and multifamily sectors were the only ones to show value growth in February, moving up 3% and 4% in average asking price. While both of these increases were at a slower clip than the previous month. The gains represent industrial and multifamily owners’ continued willingness to capitalize on returns and jump into a high-demand market.

Office and retail pricing holds steady with favorable occupancy rates and search activity gains.

Both office and retail property types remained unchanged in asking prices month over month, but other metrics indicate promising improvements in each sector. For offices, occupancy rates jumped more than 5% from the previous month, coinciding with the lifting of COVID restrictions. Overall, an improved sentiment from employers about returning to the workplace.

On the retail side, there was a noticeable surge in search activity from investors.

A surge in new for-lease assets came online in February with minimal change to asking rates.

Average asking lease rates remained virtually unchanged month over month, yet Glenn Group witnessed new lease spaces come online in the same period. With COVID restrictions lifting in the most populated markets, this supply growth and unchanged pricing point to good times ahead for tenants.

Disclaimer: This article’s information is based on our internal marketplace data and additional external sources. While asking price in many ways reflects market conditions, variations in pricing are affected by changes in inventory, asset size, etc. Nothing contained on this website is intended to be construed as investing advice. Any reference to an investment’s past or potential performance should not be construed as a recommendation or guarantee towards a specific outcome.